Results for State Government

Displaying posts 1 - 10 of 101 in total- Type:

- Businesses

- Blogs

By Stephanie Curry, an attorney and Policy Manager for Family Policy Alliance Last week, we shared the jarring news that the state of Ohio had removed a young girl (who identifies as a boy) from her home because her parents refused to allow their daughter to be subject to extreme and irreversible medical interventions in …

It is a rare occurrence for a government program to be both popular with the public and produce revenue for the U.S. Treasury.

CHEYENNE – For the past two years, Wyoming has tried to find ways to make state government run as efficiently as possible.

Governments across the globe have begun evolving from lumbering bureaucracies into smaller, more agile special jurisdictions. Private providers increasingly ...

Overwhelmed by alerts and constrained by limited resources, state government needs a new battle plan to fight digital threats and attacks. Artificial intelligence could be the answer.

Here are five cool ways we’ve found state and local governments using Zoom to support the public.

Members of the National Association of State Auditors, Comptrollers and Treasurers say it’s these five areas that usually trip up IT departments.

Dear Lifehacker,Every month my paycheck gets sliced up to pay down different kinds of debt—student loans, a car loan, and a credit card balance that's almost paid off. These loans are weighing on me like a bad conscience. But I know I'm not the only one in this situation. Is my debt really that bad?

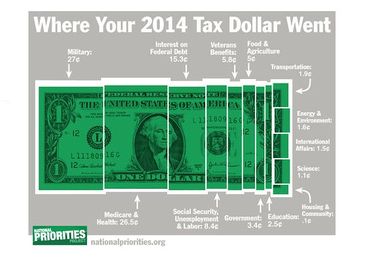

More than half your federal-income tax dollars were spent on the military and health care in 2014.

It's nice to have more money in your pocket. And thanks to the 2017 tax cuts, the typical American is now paying less in taxesBut that's not to say we're not still sending a hefty sum of money to Washington. Tally up all the payroll and other taxes on earnings and income, and you'll find that the average American household forks over more than $26,000 to the feds each year. Last year, Washington collected more than $3.3 trillion in taxes. So where…